Case Study: Martin, IT Professional

Snapshot of Recent Examples

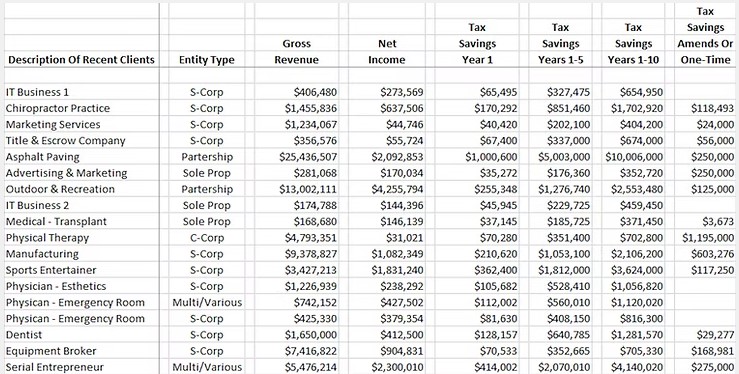

Our proven tax-saving strategies deliver exceptional results across a wide range of industries, business structures, and company sizes. Regardless of revenue or net income levels, our tailored approach ensures significant savings and optimized financial outcomes for every client. See examples below.

Our tailored tax strategies have saved clients across industries up to $4.1 million over 10 years. Results may vary and depend on individual circumstances.

$4.1 million over 10 years

Why Tax Planning

Most financial professionals agree that taxation is the primary factor eroding income and wealth generation. Tax planning involves exploring a range of strategies to determine the optimal timing, methods, and structures for both business and personal transactions. The goal is to significantly reduce or even eliminate tax liabilities. The choices you and your tax advisors make today will play a crucial role in safeguarding or diminishing your hard-earned income and wealth.

Executive Summary

Martin, an IT professional owner of a highly profitable consulting firm, works for several high-profile companies and the Department of Defense. Over the past ten years and with two CPAs, Martin has paid over $635,000 in taxes to the IRS, state, and local tax agencies. In 2018, he broke free from the tax matrix and got a tax refund for the first time in twelve years. What changed for Martin?

Challenges

Martin, a seasoned IT professional and owner of a highly successful consulting firm, collaborates with prominent corporations and the Department of Defense. Despite his success, over a decade—and with the guidance of two different CPAs—Martin paid a staggering $635,000 in taxes to federal, state, and local authorities.

Victory

In 2018, everything changed. Martin broke free from the tax matrix and overwhelming tax burden for the first time in twelve years, received a tax refund. What made the difference? A strategic, forward-thinking approach to tax planning that shifted his financial trajectory.

Words from our President

“Martin is a true success story. But the reality is, this kind of success is par for the course when you develop a cohesive and holistic tax plan. This plan becomes the blueprint for asset protection, wealth creation, and business succession. This is all possible because he has a team of professionals at his back and has learned the old adage of paying himself first, and reinvesting in his business, thus avoiding the tax matrix.”

Gregory G. Bourque, MTAX, CASL

How Our Services Helped

That’s when Martin found us—a chance meeting that he didn’t let pass by. After sitting down with him, we quickly identified his tax exposure and designed tailored strategies to reduce and even eliminate his tax burdens.

Beyond Tax Savings

But reducing his tax bills was just the beginning. Through the process, Martin gained valuable insights on protecting his business and his family, building wealth, and securing his retirement. Additionally, we helped him position his business for a future sale, ensuring he can minimize the tax consequences when the time comes to sell.

Results, ROI, and Future Growth

“The Principals at Tax Plan Advisors were totally professional, highly knowledgeable, a pleasure to work with and helped me immensely with my client. Tax Plan Advisors included me in every meeting with my client as well as strategy development and implementation discussions.”

-Financial Planner

“As a financial advisor it is critical to have strategic partners such as accountants that can work together to accomplish my client’s goals. Working as partners in a collaborative effort to help my clients has been the biggest benefit in working with Tax Plan Advisors. They understand my viewpoint as an advisor and can help by being a second resource for clients to call on. There have been many times where a strategy may have been met with skepticism at first but later accepted after consulting with their tax advisor. There have also been extra lines of revenue opened up by working with Tax Plan Advisors as well. For all of these reasons I highly recommend other financial advisors to seek out a partnership with experienced and collaborative tax planners such as the experts from Tax Plan Advisors.”

– DP, Financial Advisor